November 27, 2025

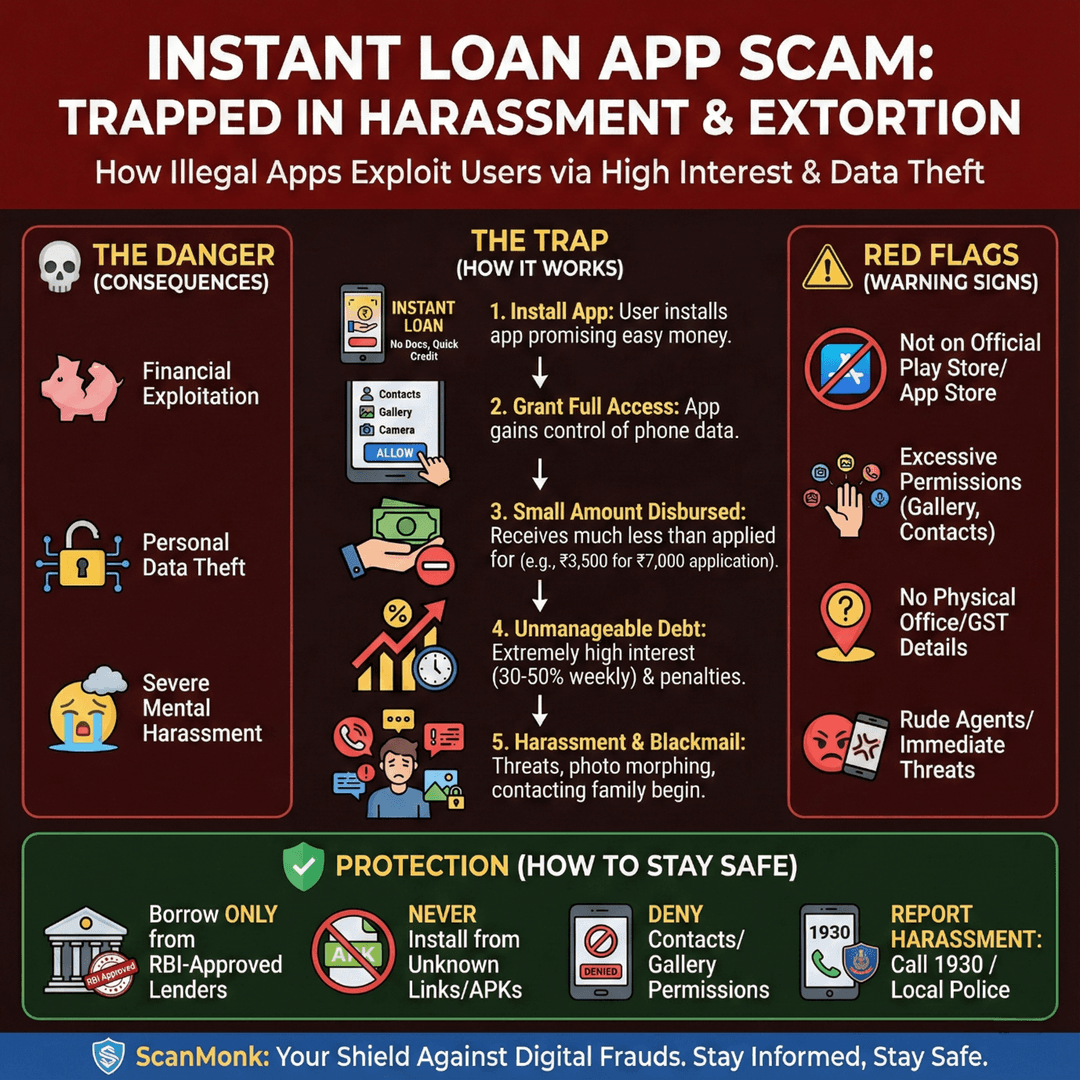

Instant Loan App Scam: How Illegal Apps Trap Users into Harassment and Extortion

tanishka-ratn

In the last few years, India has seen a major rise in instant loan apps that promise quick credit without documentation.

While some apps are legitimate, hundreds of illegal apps have entered the market, offering small loans but trapping users in a cycle of harassment, blackmail, and extortion.

These apps target students, job seekers, young professionals, and people facing financial emergencies.

This blog explains how the scam works, how these apps operate, and how users can protect themselves from one of the most dangerous financial fraud ecosystems.

What Is the Instant Loan App Scam

The Instant Loan App Scam involves unregistered digital lenders providing small loans (usually 1,000 to 10,000 rupees) through mobile apps.

While the initial loan approval is fast, the actual purpose of these apps is to:

- Access personal data

- Charge extremely high interest rates

- Force users to repay more than they borrowed

- Harass and threaten them if they delay repayment

These apps are usually not RBI-approved and operate outside legal frameworks.

How The Scam Works

1. The User Installs an App Offering Instant Credit

Illegal loan apps aggressively advertise:

- No documentation

- No credit score required

- Instant approval

- Money transferred within minutes

These ads appear on Instagram, YouTube, and third-party app stores.

2. The App Takes Full Access to the User's Phone

During installation, the app asks for permissions such as:

- Contacts

- Gallery

- Camera

- Microphone

- SMS

- Call logs

- Storage

Once granted, the app gains access to the user’s entire phone data.

3. Very Small Loan Amount Is Disbursed

Users are usually given much less money than they applied for.

For example, if someone applies for 7,000 rupees, the app may disburse only 3,500 rupees after deducting:

- Processing fees

- Penalty

- Service charges

4. Extremely High Interest Rates

Most apps charge:

- 30 to 50 percent weekly interest

- Daily penalties

- Automatic renewals

- Additional surprise charges

The loan becomes unmanageable within days.

5. Harassment and Threats Begin

If the user delays even for one day, the loan app agents start:

- Calling the user repeatedly

- Messaging aggressively

- Threatening to inform family and friends

- Sending edited photos

- Blackmailing using contact access

- Circulating fake defamatory messages

- Threatening legal action

Some apps even create fake FIR letters, loan notices, or legal threats to scare victims.

6. Sharing Photos and Private Data

Because the app has access to the gallery and contacts, scammers blackmail victims by warning:

- They will send photos to contacts

- They will leak personal images

- They will shame the victim publicly

- They will manipulate images

Many victims pay out of fear, even if they never intended to default.

Why People Fall for the Scam

1. Financial Urgency

People needing quick money during emergencies become vulnerable.

2. Low Eligibility Requirements

Scammers take advantage of users who cannot get bank loans.

3. Lack of Awareness

Most users do not know the difference between legal and illegal digital lenders.

4. Easy App Access

These apps spread through YouTube ads, Telegram groups, APK links, and unauthorised app stores.

5. Instant Disbursement

Fast approval creates a false sense of trust.

Red Flags to Identify Illegal Loan Apps

- Not listed on the Google Play Store or the iOS App Store

- Asking for extreme permissions like contacts and gallery

- No office address or GST details

- The loan amount is lower than what was promised

- Interest rates are not clearly mentioned

- Agents misbehave on calls

- Threats of legal action within hours of taking the loan

- Fake legal documents or notices

- Multiple apps connected to the same operator

- No customer support email or website

If even one of these signs is present, the app is likely illegal.

How to Stay Safe

1. Borrow Only From RBI-Approved Lenders

Check if the lender is registered as an NBFC or is partnered with a bank.

2. Never Install Loan Apps from Unknown Links

Avoid APK files, Telegram links, and third-party stores.

3. Check App Permissions

If an app asks for contacts, gallery, or microphone, avoid it immediately.

4. Read Reviews and Ratings Carefully

Fake apps often have many negative reviews describing harassment.

5. Never Share Aadhaar, PAN or Photos with Suspicious Apps

Scammers misuse identity documents.

6. Do Not Panic if Harassed

Illegal lending operations have no legal power to threaten or defame users.

7. Report Immediately

If harassed, report to:

- Cyber Crime Helpline 1930

- National Cybercrime Portal

- Local police

Keep screenshots of messages and call logs as evidence.

How ScanMonk Helps Users Stay Safe

ScanMonk regularly publishes:

- Scam alerts

- Awareness posts

- Website verification tools

- High-risk app warnings

- Analysis of trending frauds

Our goal is to help users identify unsafe digital platforms before they risk money or personal data.

By building India’s e-commerce trust layer, ScanMonk empowers people to make safe financial and online decisions.

Conclusion

Instant Loan App Scams have become one of the most dangerous digital fraud networks in India.

They combine financial exploitation, personal data theft, and mental harassment.

The best protection is awareness.

Users must borrow only from verified lenders, avoid unknown loan apps, safeguard their data, and report harassment immediately.

With proper caution and education, users can stay safe from illegal digital lending traps.